Comstock boosts your company’s value.

- Uses AI, wargaming and design thinking to reduce enterprise risk

- Raises capital at higher valuations by reducing risk

- Ramps growth through its C-suite network

- Partners with management to build great companies

Comstock understands growth and its challenges.

- Has founded, worked in and advised growth companies

- Knows that growth entails both excitement and pain

- Combines “old school” values with state-of-the-art thinking

EXPERIENCE: We are seasoned professionals with access to an international network of industry and subject experts.

We’ve been employees and advisors at the most senior levels of leading multinational companies, including: Amgen, Avon, CBS, Chrysler, Citibank, Club Med, Delta Airlines, Drexel, Burnham, E&J Gallo, Ford, Holiday Inns, Honeywell, KKR, JM Smucker, Johnson’s Wax, Louis-Dreyfus, Lehman Brothers, McKinsey, NBC, NetZero, Occidental Petroleum, Revlon, Staples, The World Bank, Transamerica and Walt Disney.

We’ve held senior command positions in the military.

Risk Resiliency

We live in a rapidly-moving, ever-changing environment: economics, technology, politics, regulation, international events, strikes, and disasters.

Every business faces new opportunities and threats almost daily. To win, a business must first survive.

Risk-resilient strategies enable you to:

- Withstand sudden and unexpected challenges

- Quickly identify critical changes in the firm’s business environment

- Readily develop responsive strategies and tactics based on the current strategy and positioning of the firm

Most companies have a low level of risk awareness, exposing them to risk they aren’t even aware of.

Boards spend only 9% of their time considering risk.

(2017: 1,126 sample)

Only 6% believe they are effective at managing risk.

“On strategic opportunities and risk trade-offs, boards should foster explicit discussions and decision making among top management and the businesses.”

McKinsey: October 2018

THE COMSTOCK APPROACH: Create Risk-Resilient Strategies

THE PROCESS

ARTIFICIAL INTELLIGENCE (AI)

The ability of a computer to perform tasks commonly associated with intelligent beings.

Elephant Hunting

Many businesses have a rich trove of highly-relevant data, proprietary and available from third parties. The problem is that most businesses don’t know how to use, mine or interpret the data. AI and data science enable identification of opportunities and threats that humans otherwise might not observe: the “elephant”.

These results are important elements for the next phase: Wargaming.

WARGAMING

An interactive, iterative competitive process that rigorously identifies risks, opportunities, options, and the inherently irrational factor of human decisions.

Militaries have used Wargaming since the late-1700’s with great success. Wargaming has been effectively applied to all aspects of military operations: supply chain, strategic planning, recruiting, personnel, etc.

The same techniques can produce similar results in business.

Wargaming is not predictive, but often reveals insights no other analytic tool can.

HOW DOES WARGAMING WORK?

Wargaming solves problems by providing a holistic environment where it’s mandatory to challenge the status quo.

- Forces teams to deal with the competition and the world as they actually are, not as they hope or wish them to be.

- Explores possible futures, tests strategies, promotes innovation and teaches at very low cost.

- Identifies both opportunities and threats.

Solutions are more readily accepted by the enterprise since they are jointly developed by managers at multiple levels.

Result: Significantly reduced enterprise risk.

Comstock’s team incorporates retired senior Navy officers and includes several admirals.

These officers have successfully applied wargaming throughout their careers to problems as diverse as:

- Strategy assessment and development

- Acquisition strategy

- Organization structure

- Combat planning

- Crisis management and risk mitigation

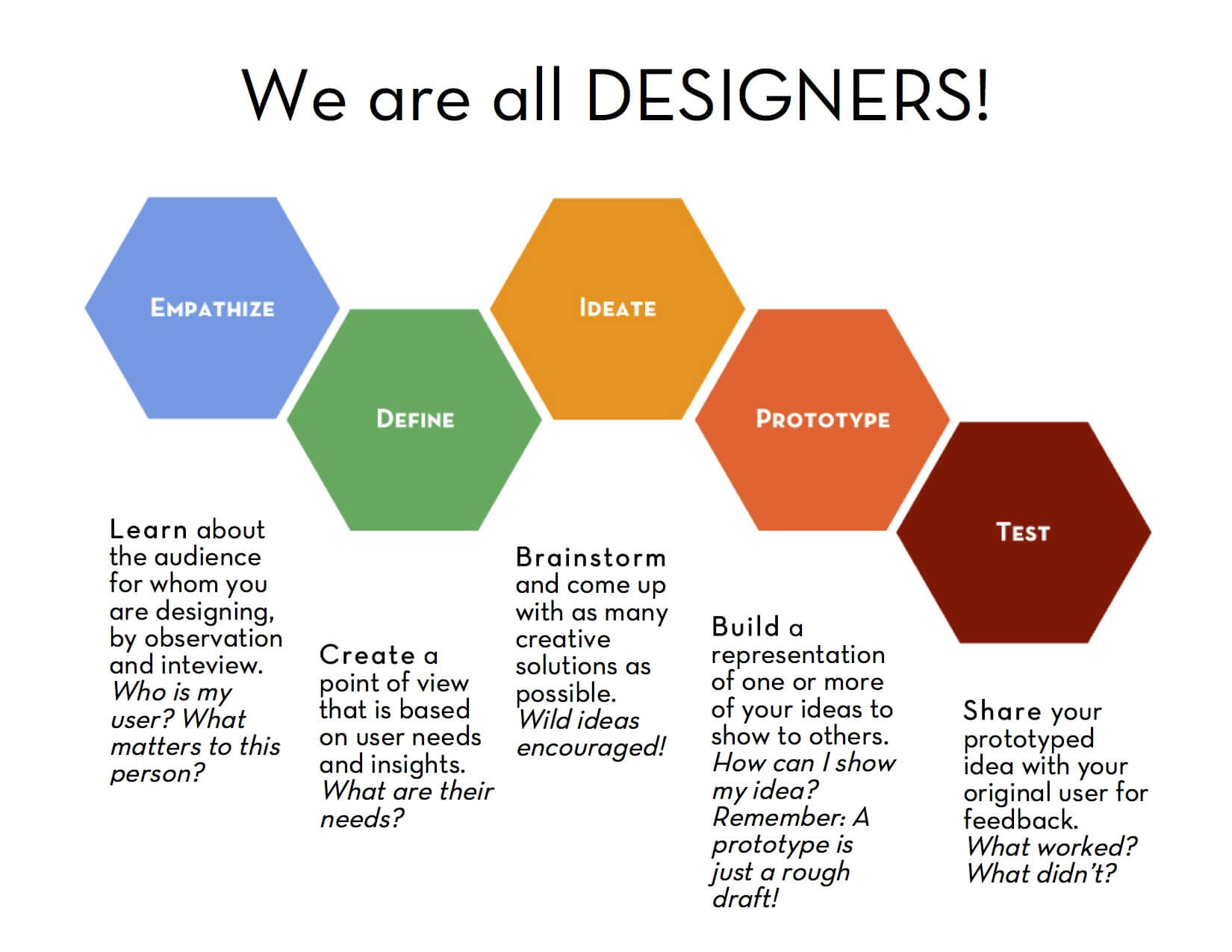

DESIGN THINKING

A balance of analytical and intuitive approaches.

DESIGN THINKING is an interactive problem-solving technique.

It yields high-impact solutions that produce a true competitive advantage.

ANALYTICAL + INTUITIVE

Companies typically usually favor the analytical over the intuitive because of the false sense of security that numbers provide. However, a given number is only a “point estimate” of a probability distribution, not a given fact.

Neither approach works well by itself. Reliance on one approach to the exclusion of the other often leads to disaster.

Comstock uses Design Thinking to produce unique, high-impact strategies.

We leverage the opportunities and minimize the threats identified by Wargaming.

THE POWER OF DESIGN THINKING: Procter & Gamble

AG Lafley is named CEO of Proctor & Gamble in 2000.

In less than 6 months, P&G had dropped from the 21st most valuable company in the world to the 51st.

Lafley introduced Design Thinking and—within three years—P&G’s market value doubled to almost $200 billion.

Within six years:

- Thirteen of P&G’s top fifteen brands increased market share

- P&G’s roster of billion-dollar brands doubled from ten to twenty

- R&D spending declined from 4.8% of sales to 3.6%—but the success rate of new products quintupled to 65%

- Profits had doubled and were growing at 15% per year

COMSTOCK: Reducing Risk to Access Capital on Superior Terms

SUCCESSFUL INVESTORS CONSIDER RISK AS WELL AS RETURN

Significantly lowering a company’s risk improves its chances for success.

Lower Cost of Capital

A low-risk company can borrow on improved terms with respect to both rate and less restrictive covenants.

Higher Sustainable Valuation

A low-risk company attains a higher sustainable valuation, resulting in reduced dilution and an enhanced exit value.

More Possibilities

Lowering a company’s risk increases the universe of potential investors and/or acquirers.

Comstock leverages a broad network of senior corporate relationships, domestic and international, to grow your company.

We’ve transacted business on six continents, including initiating the first joint venture between the People’s Republic of China and a Fortune 100 company.

Comstock can introduce clients to C-suite executives in most companies.

We recently introduced a supply chain management client to the:

- CEO of a leading brewery

- CEO of a grocery retailer owned by a major PE fund

- CEO of a major department store chain

- Co-Founder of one of the top five private equity firms

- CFO of a leading housewares retailer

- President of a leading sporting goods company

- Board member of one of the top five US grocers

- Head of store design of a leading tech company